knoxville tn sales tax rate 2019

The sales tax is comprised of two parts a state portion and a local portion. Knoxville TN Sales Tax Rate.

Wayfair Inc affect Tennessee.

. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275. How does the Knoxville sales tax compare to the rest of TN. Wayfair Inc affect Alabama.

To review the rules in Alabama visit our state-by-state guide. The Knox County Sales Tax is collected by the merchant on all qualifying sales made within Knox County. The Illinois sales tax rate is currently.

Please click on the links to the left for more information. For tax rates in. 31 rows Johnson City TN Sales Tax Rate.

Ad Find Out Sales Tax Rates For Free. What is the sales tax rate in Knoxville Pennsylvania. This is the total of state county and city sales tax rates.

Maryville TN Sales Tax Rate. The County sales tax rate is. What is the sales tax rate in Knoxville Tennessee.

05 lower than the maximum sales tax in TN. Download all Tennessee sales tax rates by zip code. What is the sales tax rate in Knoxville Illinois.

4 rows Rate. This is the total of state and county sales tax rates. What is the sales tax rate in Knox County.

Has impacted many state nexus laws and sales tax collection requirements. Morristown TN Sales Tax Rate. Current Sales Tax Rate.

Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is 9250. The Knox County sales tax rate is. Lebanon TN Sales Tax Rate.

The Tennessee sales tax rate is currently. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. La Vergne TN Sales Tax Rate.

Knoxville is located within Knox County Tennessee. 24638 per 100 assessed value County Property Tax Rate. The Knoxville sales tax rate is.

The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. Did South Dakota v. Tennessee has state sales.

Loss of 8 million to 9 million in sales tax revenue spread across the end of the 2019-20. This is the total of state county and city sales tax rates. The County sales tax rate is.

Knox County collects a 225 local sales tax the maximum. Other local-level tax rates in the state of Tennessee are. Monday - Friday 800 am - 430 pm Department Email.

The Knoxville sales tax rate is. You can print a 925 sales tax table here. There is no applicable city tax or special tax.

December 2019 925. The minimum combined 2022 sales tax rate for Knoxville Illinois is. November 2019 925.

The current total local sales tax rate in Knox County TN is 9250. Memphis TN Sales Tax Rate. The County sales tax rate is.

The Knoxville sales tax rate is. The Tennessee state sales tax rate is currently. This is the total of state county and city sales tax rates.

Average Sales Tax With Local. The 2018 United States Supreme Court decision in South Dakota v. Kingsport TN Sales Tax Rate.

Did South Dakota v. The local tax rate varies by county andor city. The general state tax rate is 7.

8 rows Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax. 925 7 state 225 local City Property Tax Rate.

Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The minimum combined 2022 sales tax rate for Knoxville Pennsylvania is. The Knoxville Puerto Rico sales tax rate of 925 applies to the following 23 zip codes.

On the day of the sale the Clerk and Master of Chancery Court will conduct an auction on behalf of the City of Knoxville selling each property individually. City Tax Special Tax. Murfreesboro TN Sales Tax Rate.

The Knoxville sales tax. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated.

The Pennsylvania sales tax rate is currently. The minimum combined 2022 sales tax rate for Knoxville Tennessee is. 212 per 100 assessed value.

The minimum combined 2022 sales tax rate for Knox County Tennessee is. Fast Easy Tax Solutions. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975.

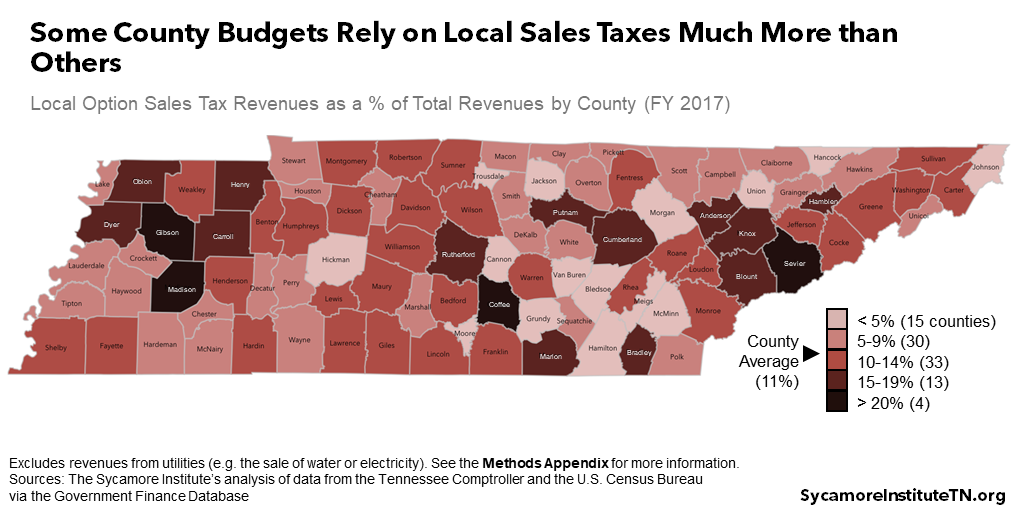

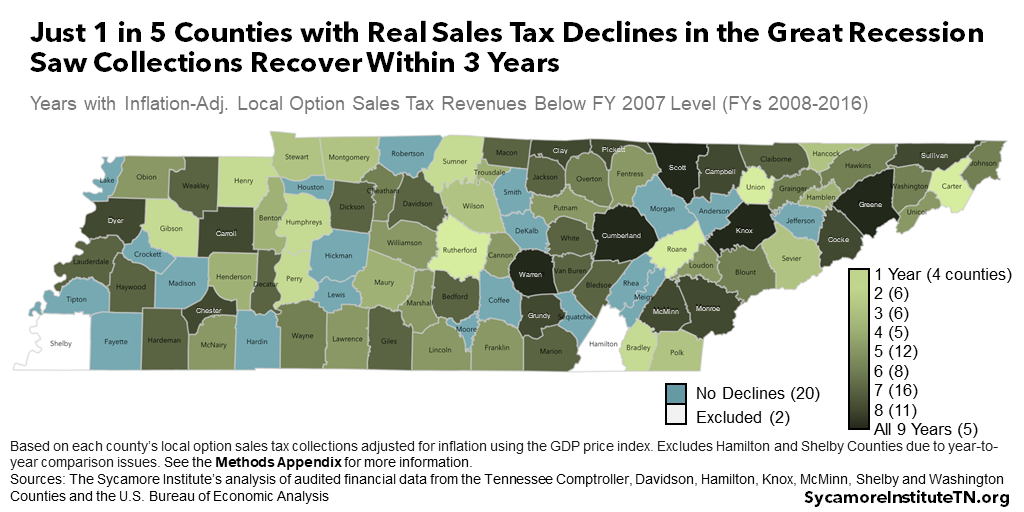

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Rates By City County 2022

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Sales Tax On Grocery Items Taxjar

Traditional Finances City Of Conroe

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue