how much did you pay in taxes doordash

Do I have to pay taxes. It doesnt apply only to DoorDash.

Doordash Taxes Does Doordash Take Out Taxes How They Work

However you may now be wondering what the process is.

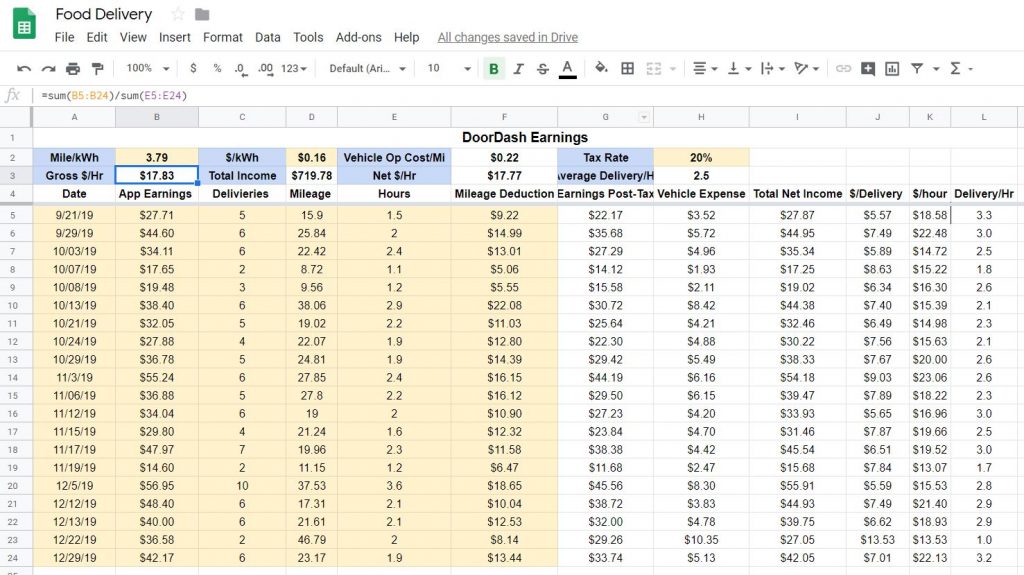

. But thats strictly an estimate. Dashers are self-employed so they will pay the 153 self-employment tax on their profit. If you get your mile to dollar ratio high enough you might have to pay some but for most of us you will likely have to pay 0 or even.

That said the rule of thumb is to set aside 30 to 40 of your profits to cover state and federal taxes. Dashers will not have their income withheld by the company to pay for these taxes so youll need to. By the way its not a.

The self-employment tax is your Medicare and Social Security tax which totals 1530. How Much to Pay DoorDash Taxes. If you owe above 1000 in taxes from your gig job you will pay quarterly taxes.

So on the first 9700 dollars you will pay 10 or 970 dollars in taxes. However you may now be wondering what the process is for filing DoorDash taxes in 2022 to ensure you cover any tax liability. A 1099-NEC form summarizes Dashers earnings as independent contractors in.

How much do DoorDash drivers make after gas. No tiers or tax brackets. There is no fixed rule about this.

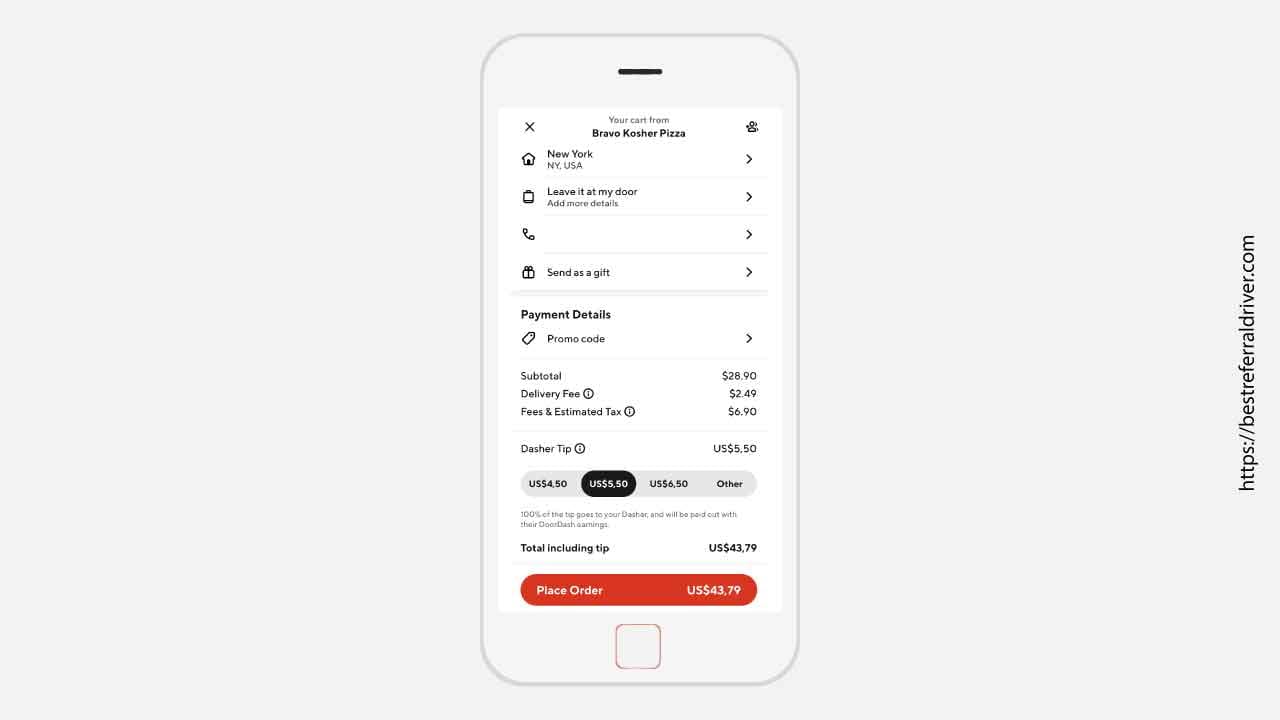

If youre self-employed though youre on the hook for both the employee and employer portions bringing your total self-employment tax. How Much Tax Do You Pay On Doordash. In some regions we offer DashPassa subscription program that offers a 0 delivery fee and reduced service fees for subscribers when ordering 12 or more from any DashPass-eligible.

The only real exception is that the Social Security part. Then on the 9701-11000 dollars you would need to pay 12 of that. If you earned more than 600 while working for DoorDash you are required to pay taxes.

The forms are filed with the US. This is a flat rate for gig work so youll pay the. Yes - Just like everyone else youll need to pay taxes.

Dashers pay 153 self-employment tax on profit. The money left over is the basis for your taxes. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes.

Additionally you will have to pay a self-employment tax. If you had 20000 in earnings and 10000 in expenses your profit is 10000. How much do you pay in taxes if you doordash.

You can figure this out by subtracting 11000-9701. A 1099 form differs from a W-2 which is the standard form issued to employees. Internal Revenue Service IRS and if required state tax departments.

Depends on how much you cherry pick orders really. Then you subtract the expenses from the income. The main exception is if you made under 400 in total.

Either way your estimate should be about the same 25-30. Looking at the costs of fuel maintenance repairs and depreciation youll be spending at least. Solved You will owe income taxes on that money at the regular tax rate.

If you would have had to pay 500 on tax day based on your other income but now you have to pay 2500 after accounting for your Doordash income tax impact is 2000. Do you have to pay DoorDash taxes under 600. There are no tax deductions or any of that to make it complicated.

Its a straight 153 on every dollar you earn. You still have to pay taxes if you made under 600 and didnt receive a 1099.

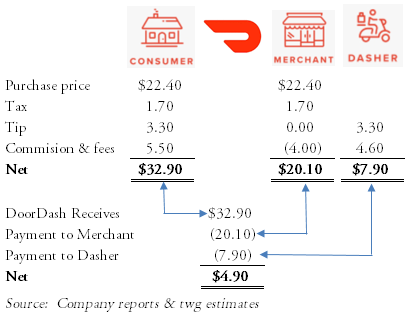

No Free Lunch But Almost What Doordash Actually Pays After Expense Payup

How To Do Taxes For Doordash Drivers 2020 Youtube

Forgot To Track Your Miles We Ve Got You Covered 2020 Taxes

Do I Have To Report Doordash Earnings For Taxes If I Made Less Than 600 On Their Platform Quora

Doordash Fees How Much Does Doordash Cost In 2022

Doordash Driver Pay After Taxes Is It Worth It 2021 2022 Youtube

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

Chart Doordash Builds On Pandemic Gains In 2021 Statista

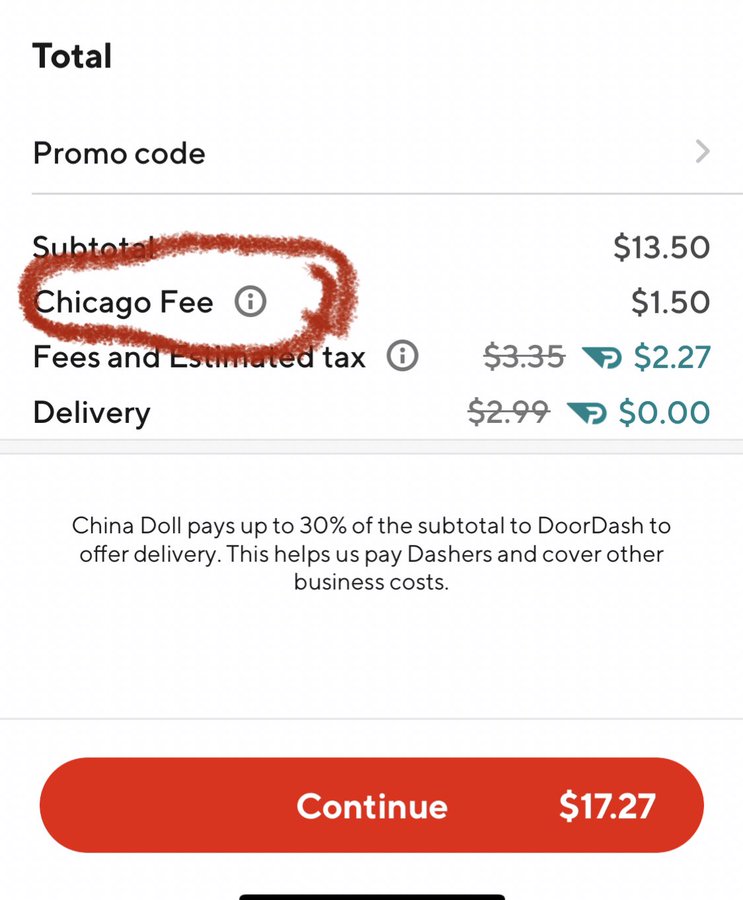

Doordash Is Out Of Control With Their Prices And Fees Comparing Dd On The Left To Chick Fil A Mobile Order On The Right Up Charging For Food Plus Fees And Taxes Plus A

Doordash Filing 1099 Taxes The Process Youtube

Doordash 1099 Taxes And Write Offs Stride Blog

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Doordash With An Electric Vehicle Charged Future

Prepare For Tax Season With These Restaurant Tax Tips

Doordash Took Marketshare And The Best Customers During Covid Nyse Dash Seeking Alpha

New Doordash Fees In Nearly A Dozen Markets Frustrate Diners Officials